Roth Conversion Deadline 2025 - Roth Conversion Calculator Use Our Roth IRA Conversion Calculator For, After ‘misery’ for tax filers in 2025, irs to start 2023 tax season stronger, taxpayer advocate says. For 2025, maximum roth ira contributions are $7,000 per year, or $8,000 per year if you are 50 or older. Guide to Roth Conversions Why, When, and How Much to Convert, These limits do not apply to conversions. The roth ira contribution limit for 2023 is $6,500 for those under 50, and $7,500 for those 50 and older.

Roth Conversion Calculator Use Our Roth IRA Conversion Calculator For, After ‘misery’ for tax filers in 2025, irs to start 2023 tax season stronger, taxpayer advocate says. For 2025, maximum roth ira contributions are $7,000 per year, or $8,000 per year if you are 50 or older.

Roth Conversion Deadline 2025. Any roth conversions done for the tax year 2025 could affect your. Use our roth ira conversion calculator to compare the estimated future values of keeping your traditional ira vs.

The roth ira contribution limit for 2023 is $6,500 for those under 50, and $7,500 for those 50 and older.

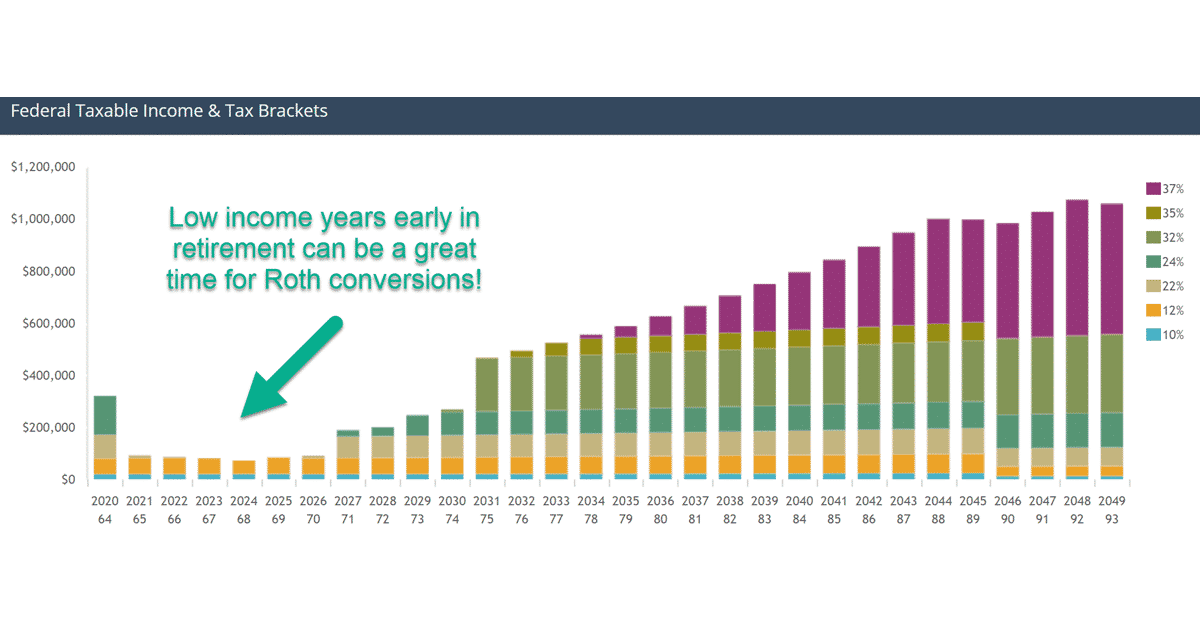

Is Now the Time for a Roth Conversion? Wealthramp, Tax rates are set to rise in the. Limits on roth ira contributions based on modified agi.

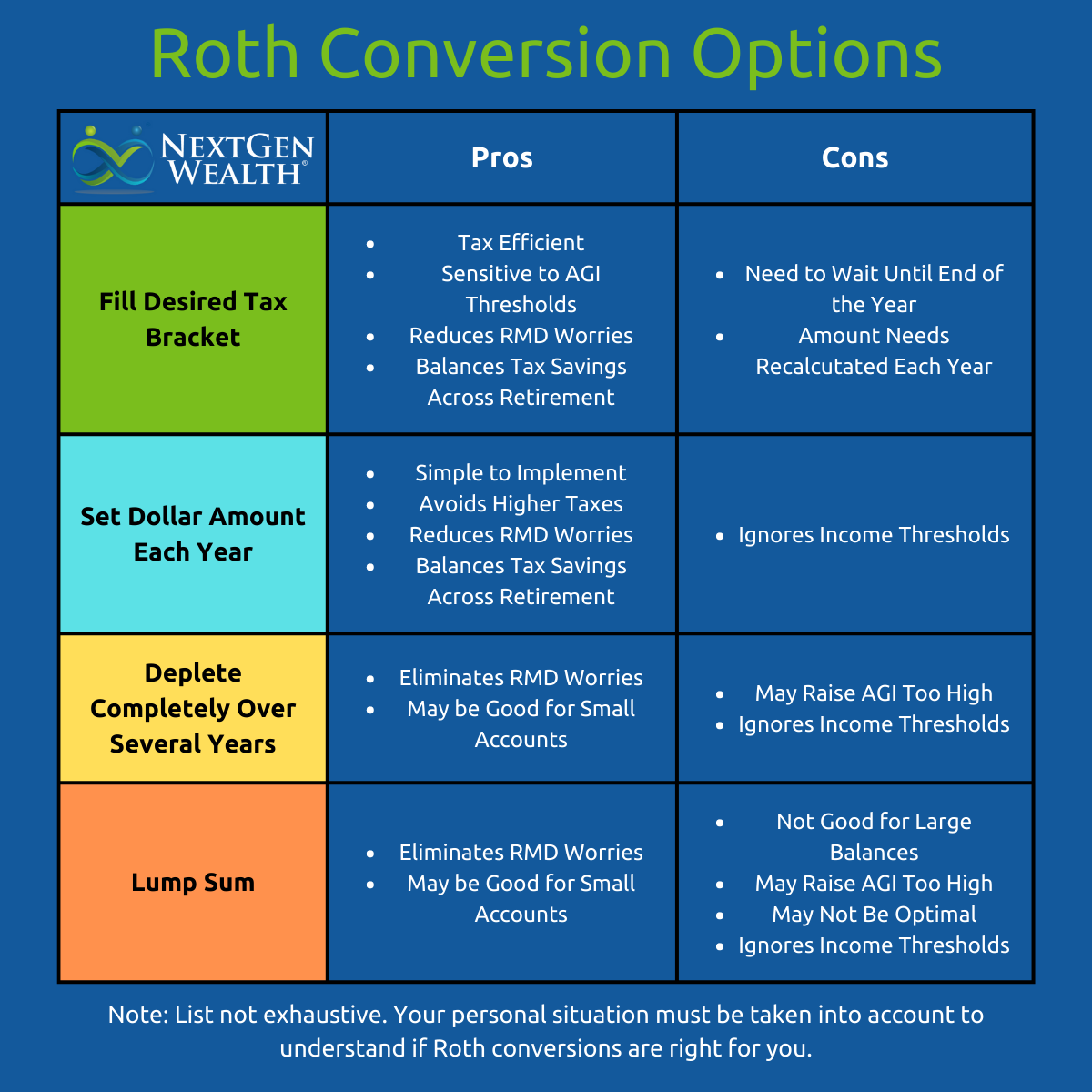

When to time your Roth IRA conversions, Use our roth ira conversion calculator to compare the estimated future values of keeping your traditional ira vs. One of the key financial strategies in 2025 is the roth ira conversion.

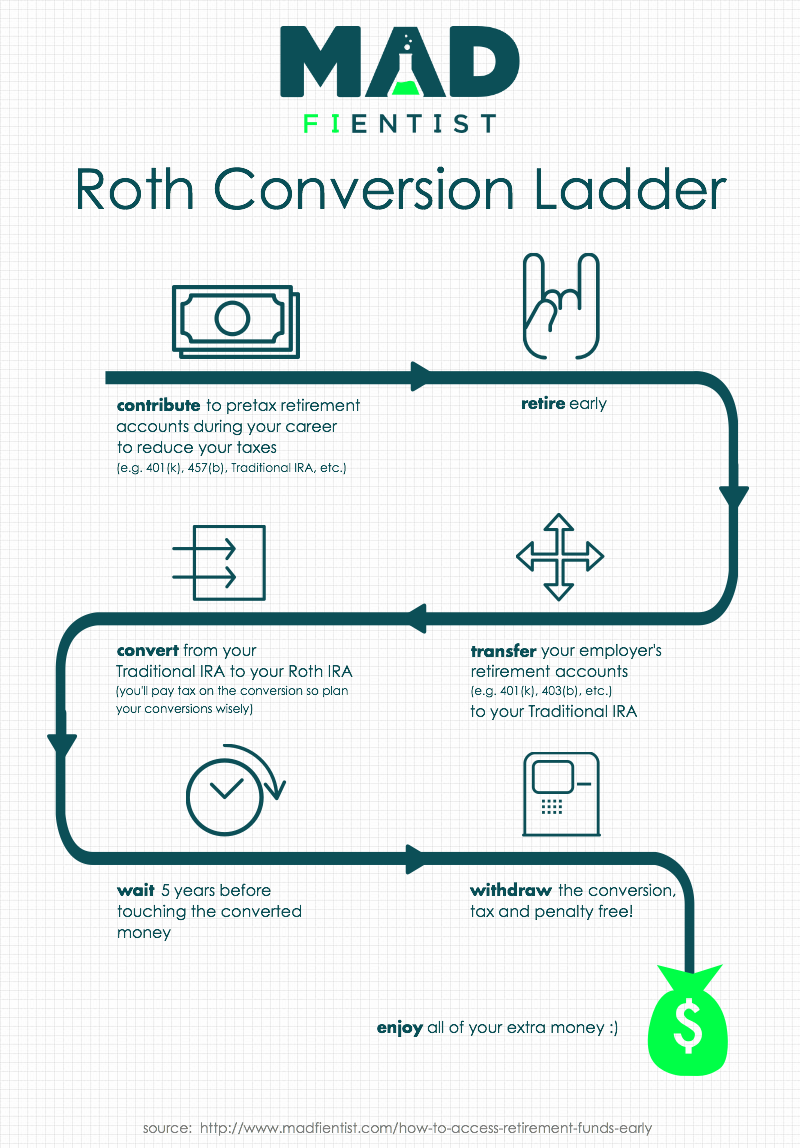

Roth Conversion Ladder and SEPP How to Access Your Retirement Accounts, Converting a traditional ira to a roth ira is accomplished with two steps: If you completed a roth conversion in 2025, you’ll receive.

The deadline for a roth conversion is also different.

Your Guide to Roth Conversions Kiplinger, With strategic tax planning, roth ira conversions can offer individuals favorable aspects of both traditional iras and roth iras. Roth ira contribution phases out entirely for income above.

Calculating the Right Amount of Roth Conversions, Converting it to a roth. For 2025 medicare part b premium costs range from the low of $148.50 to a high of $504.90.

Roth IRA Conversion Definition Finance Strategists, Deadline to convert at fidelity. Converting it to a roth.

See an estimate of the taxes you’d owe if. For 2025 if your income is over $240,000 you cannot make a roth ira.